The Case For Cancelling Student Debt

Today, more than 44 million Americans hold a total of about $1.6 trillion in student debt, creating significant financial hardship that had reached crisis proportions even before the pandemic triggered massive job losses.

Executive Summary

In the space of a few years, the prospect of cancelling outstanding student loans has moved from the far-out fringe of higher education policy reforms to the center of the policy debate, and it could become actual executive branch policy in the very near future. President-elect Joe Biden, with authority over the Department of Education, could issue sweeping debt cancellation with a pen stroke, and he should. Today, more than 44 million Americans hold a total of about $1.6 trillion in student debt, creating significant financial hardship that had reached crisis proportions even before the pandemic triggered massive job losses.

Against this growing urgency, cancellation has attracted a chorus of naysayers from the usual suspects: philanthropically-ensconced wonks who try to gate-keep the public debate. But the acuity of the student debt crisis, the larger economic crisis of the pandemic, and a disposition of political forces that has made every other agreed-upon plan to assuage student debt a non-starter, have all conspired to lift up an idea they were hoping to confine to the fringes.

Indeed, public opinion research consistently shows broad popular support for student debt cancellation, including among non-borrowers. New national polling from Data for Progress and The Justice Collaborative Institute shows that:

- 55% of voters, including 52% of Republicans, support cancelling all current student debt;

- A majority of voters (51%) believe that student debt cancellation should apply universally, to all borrowers, and not just to certain groups such as low-wage workers;

- 55% of voters support President-elect Joe Biden using executive action to cancel student debt owed to or guaranteed by the federal government;**

- 55% of voters support executive action to cancel up to $75,000 in student debt per person as a response to the pandemic-induced economic crisis.

In addition to being popular, student debt cancellation is also sound policy, and the arguments against it are fatally flawed. These include the failed economic predictions underlying the expansion of the federal student loan program in the first place, the (false) claim that cancelling student debt is a regressive redistribution from the poor to the rich, the fact that a large and rapidly-growing share of outstanding student debt is never going to be repaid regardless of whether we cancel it now, and the racial inequality built into higher education and its financing from the start, which cancellation would go a long way to mitigate.

How we got here

There are three fundamental reasons for the student debt crisis.

First, public funding for higher education has been slashed, shifting nearly every institution toward a tuition-based business model. Second, that trend has been supported by a relatively open-handed federal policy when it comes to originating loans. The federal view is that more people should be able to pursue more higher education whatever the tuition. Hence loan limits have increased, and federal student loans come with more favorable terms than most unsecured debt. Third, and most importantly, more people want to attend college thanks to the raising of credential requirements for any given job or salary, what scholars have come to call “credentialization.” More people pursuing more degrees also means more diverse people pursuing more degrees, and that in turn means an increasingly non-traditional student population that is less able to rely on parental help to pay for college or graduate school.

State legislators slashed public higher education budgets because they assumed that, given the college earnings premium, tuition loans would essentially finance themselves with higher pay. Moreover, like Pete Buttigieg, they came to believe that public higher education is a transfer from worse-off, non-college-educated taxpayers to well-off college students, who are likely to be the children of the college-educated. Better to make them pay for it themselves, and if they or their parents can’t afford to fork out that much cash at age 18, the federal government will underwrite the loans, with the understanding that higher earnings for college grads would make it possible to pay the government back in the long run.

The rising mountain of federal student debt is the accumulating evidence that these predictions were based on false assumptions. Earnings did not in fact go up to pay for the higher tuition necessary to absorb cuts to public funding. Quite the contrary, conditional on educational attainment, earnings have declined. The only reason earnings overall are stagnant is that people are getting more degrees, putting themselves in higher educational attainment categories than they would otherwise. They’re doing that by taking on student debt, which, in more and more cases, they will never pay off or even pay down.

In effect, the federal government has bailed states out of their cuts to higher education funding, by nominally shifting the financial burden onto the shoulders of individuals with legal obligations they can’t repay because the labor market doesn’t work the way that policymakers said it would. Income-Driven Repayment (IDR, discussed further below) represents the recognition that the loans will be largely forgiven eventually, and the current debate over cancellation amounts to whether borrowers should have to wait decades for that, with the debt hanging over them and impairing their financial lives, or be rid of it now. Student debt cancellation would redress a policy failure that the government itself created.

Student debt cancellation is not regressive

The answer to the question, “Who holds student debt?” has changed over time. As an increasing share of entering cohorts has come into contact with the higher education system, as average attainment has increased cohort-by-cohort, and especially as the tuition and therefore debt required to obtain any given degree has gone up, the set of people who have student debt has expanded—as has the amount that each student debtor owes. In other words, Pete Buttigieg’s conventional wisdom that college students, and specifically student debtors, are relatively privileged is simply out of date. Not having student debt is what marks you out as privileged, because that means your family was likely able to help you pay for college.

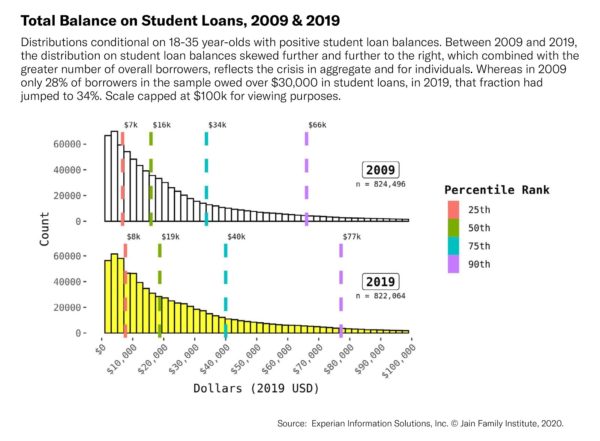

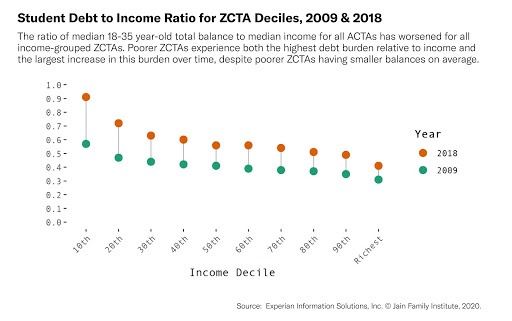

Below I re-print two charts that show the distribution of student loan balances and student-debt-to-income ratio evolving between 2009 and 2019, taken from recent work by the Jain Family Institute called the Millennial Student Debt project.

These charts, created from an annual sample of 1 million credit reports for student debtors between the ages of 18 and 35, show the distribution of student debt shifting to the right: more people have higher balances. The second chart shows that the poorest zip codes have the highest student loan balances relative to their income, and that the steepness of that negative relationship (higher income correlates with lower debt-to-income-ratio) gets more severe over time, though student-debt-to-income ratios are rising across the board. That means the historical positive relationship between student loan balance and income is getting weaker (flatter) as time goes on.

Cancelling student debt thus disproportionately relieves the burden of poorer people, and that is increasingly the case. In other words, according to the standard way progressivity and regressivity are evaluated in policy analysis, the policy is progressive: Student debt is less unequally distributed than income (and much less unequally distributed than wealth), so removing student debt would make the overall income and wealth distributions more egalitarian. Notwithstanding all the hoopla about student debt cancellation being a giveaway to the rich, no one disputes this basic fact, which is dispositive as to the question of regressivity or progressivity.

The burden of student debt is greatest on nonwhite people

By now it’s well known that the student debt crisis is most acute for nonwhite people, especially young people. Past research has identified four reasons for this: First, the underlying racial wealth gap means that nonwhite families are less able to support their children with college expenses, necessitating greater reliance on debt either by the students themselves or their families. Second, nonwhite workers suffer labor market discrimination, which is mitigated by obtaining higher credentials for the same job a white candidate would obtain with fewer credentials and therefore with less debt. Third, nonwhite borrowers are also discriminated against in the credit market, especially when it comes to the deployment and criminalization of the collections apparatus. Finally, higher education segregation means that nonwhite students are denied access to better-resourced institutions and thus default to predatory colleges more reliant on bilking students in order to sustain themselves. This is true in both the for-profit and nonprofit sectors within higher education.

The result is that racial disparities in student debt are significant upon graduating college and get worse over time: Nonwhite graduates wait longer to obtain well-paid employment (if they ever do) and more frequently need to take on even more debt to pay for graduate credentials to obtain that employment. This is the concept of “predatory inclusion” that the scholars Louise Seamster and Raphael Charron-Chenier have applied to the context of student debt.

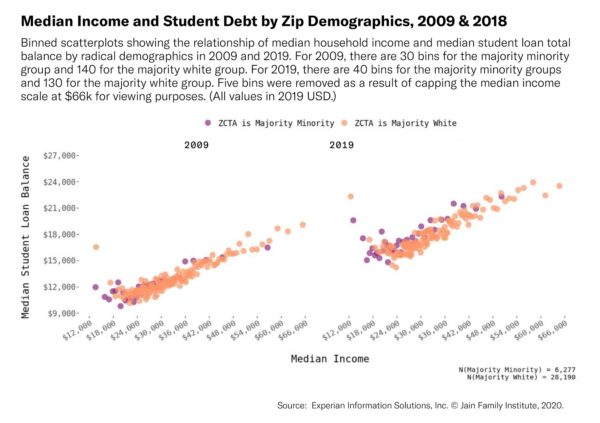

The Millennial Student Debt Project has also published data on racial disparities in student borrowing. In these charts, the zip-code-level relationship between student loan amount and income is plotted separately for majority-white and majority-minority zip codes in 2009 and 2018. These charts repeat what the last charts showed: Debt burdens have increased for everyone, but particularly for those in the poorest zip codes. Here we can further see that burdens are higher and have increased more in the majority-minority zip codes than in the majority-white ones.

Much of outstanding student debt will not be paid back

One of the central ways the federal government has dealt with the accumulation of student debt, and particularly with rising default rates since the Great Recession, is by expanding Income-Driven Repayment (IDR), including various programs that cap loan payments based on a percentage of income. Borrowers in an IDR program are not obligated to make payments sufficient to retire their loans within the standard 10-year repayment window. Instead, depending on the program, if a loan in IDR continues to have a balance after 10, 20, or 25 years of making reduced payments, that remaining balance is written off.

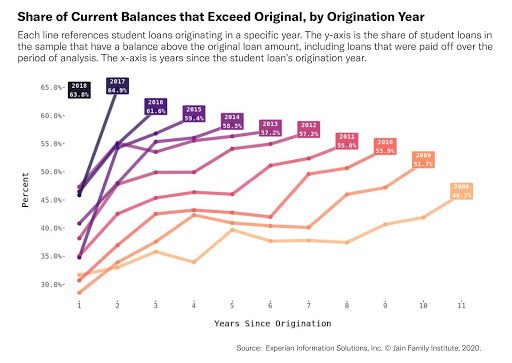

Borrowers are increasingly enrolling in IDR programs, and for that reason the balances on their loans are increasing rather than decreasing over time. The chart below (taken, again, from the Jain Family Institute’s Millennial Student Debt project) shows how that has become more severe over sequential loan origination “vintages,” meaning the cohort of loans originated in a given year, tracking that set of loans over time thereafter. The share of each vintage in which the current balance exceeds the original balance is going up both over time, within a vintage, and across vintages. We’re now at the point where the highest-balance loans are the ones most likely to increase rather than decline in balance over time, despite the conventional wisdom that the highest-balance loans are held by the highest-income borrowers.

The Education Department forecasts that only 68% of outstanding student loan balances will be repaid in full. This is probably an under-estimate. The U.K. has implemented a version of universal IDR alongside its substantial increase in university tuition fees in 2012; it forecast that 70% of its student loans will not be fully repaid (and that analysis dates to 2017). Moreover, because of the pandemic, administrative forbearance is now available to all federal student loan borrowers, meaning that no payments are due. While that policy is in place, interest rates on federal loans have been reset to zero. That policy was recently extended past the end of 2020. This is a great relief to borrowers, but it also represents the increasing extent to which the federal government is already cancelling student debt.

All of this means that substantial cancellation, or rather non-repayment of outstanding loans, is already baked into the system. It’s just pushed into the future. Under IDR, borrowers are required to make less-than-adequate payments for many years before their debt is finally cancelled. That exerts a significant drag on their financial health, to no apparent purpose, while the government is still setting itself up to not be repaid.

Some have used the availability of IDR to raise a new argument that cancellation is regressive, in order to get around the data reported above showing that it isn’t. They argue that since IDR is designed to reduce payments for people with high balances and low incomes, we should simply write off the existing balances of lower-income borrowers who are likely to not repay or repay less under IDR, acting like those balances do not exist. That analytical maneuver removes a good chunk of the student debt held by lower-income people, which means the remaining debt (that which is expected to be repaid) is held by higher income people, so cancelling it would be regressive.

Of the many flaws with this analysis (including that it mysteriously ignores the many people who hold debt but did not finish college, a group that is disproportionately low-income), the biggest is its assumption that people enrolled in IDR are not burdened by their debt if they make reduced payments on it. But the fact that they’re enrolled in IDR is very good evidence that they are in fact burdened, because they don’t earn enough to repay it. They would thus benefit from cancellation, in fact more so than those borrowers whose incomes are high enough to make their payments in full.

An example from a recent paper illustrates this faulty reasoning, when the authors address racial disparities:

In terms of balances, Blacks have the highest average loan balance, at $10,630. Whites have a lower average loan balance, at $6,157, and Hispanics and others have a much lower average loan balance of $3,996. Computing present values presents similar overall patterns, but shrinks the gap between Blacks and Whites, who respectively have present values of $7,407 and $4,962. The ratio of present value to balance is lower for Blacks than Whites.

In lay terms, the point is that despite the fact that Black people have more debt, less of it should count because they also have lower incomes, hence lower expectation of repayment under IDR. In this analysis, the fact that Black people have lower income than white people signifies that their debt is less burdensome. The reality is that because of the income disparities mentioned above, arising from labor market discrimination and other race-based causes, debt held by Black people is if anything more burdensome than debt held by white people, and hence cancellation would disproportionately benefit them.

Conclusion

Student debt should be cancelled because borrowers haven’t realized the income gains that would enable them to pay it off, the burden of student debt weighs especially heavily on the historically marginalized, and a good deal if not a majority of outstanding student debt isn’t going to be repaid anyway. Why should the government grind pointless payments out of its borrowers for the next many decades? Let’s be done with this failed policy experiment for good.

Notes on Polling Methodology

* For the first two questions, Data for Progress conducted a survey from September 18, 2020 to September 19, 2020 of 1,104 likely voters nationally using web panel respondents. The sample was weighted to be representative of likely voters by age, gender, education, race, and voting history. The survey was conducted in English. The margin of error is +/- 2.9 percentage points.

** For the final two questions, Data for Progress conducted a survey from December 4 to December 6, 2020 of 1,080 likely voters nationally using the same methodology. The margin of error is ±3.0 percentage points.

CORRECTION: An earlier version of this report cited polling showing respondents’ opposition to or support for up to $20,000 in student debt among likely voters, but the question was asked only of those respondents who indicated support for cancelling student debt more broadly. We have removed that finding from the report.