Poll: Majority of Voters Support the “Wall Street Tax Act”

A new poll shows that a majority of likely voters want Congress to pass the “Wall Street Tax Act,” federal legislation that would promote equity, fairness, and raise revenue through a tax on trades of certain financial instruments.

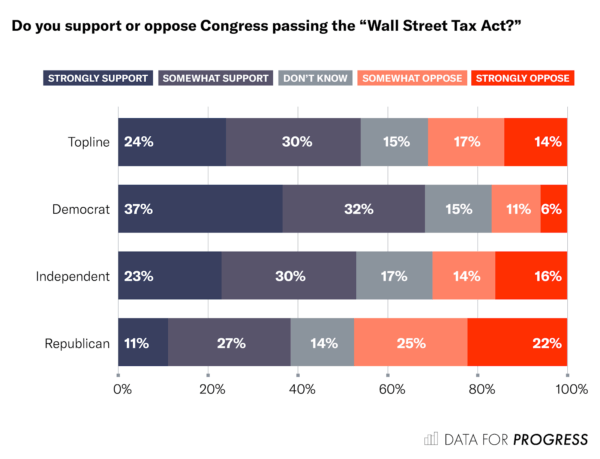

A new poll from Data for Progress and The Lab, a policy vertical of The Appeal, shows that a majority of likely voters want Congress to pass the “Wall Street Tax Act,” federal legislation that would promote equity, fairness, and raise revenue through a tax on trades of certain financial instruments. The results show that:

54% of overall voters—including 69% of Democrats and 53% of independents—support passage of the measure, which would generate an estimated $777 billion in new revenue over a 10-year period.

The proposed measure would tax sales of stocks, bonds, and derivatives at a rate of 0.1 percent—the equivalent of 10 cents per $100 sold. In addition to raising new revenue, the tax is designed to target a practice known as High-Frequency Trading (HFT), which often involves complex algorithms that execute a slew of trades in milliseconds based on miniscule shifts in prices. It would largely exempt long-term assets such as employee retirement accounts, according to Representative Peter DeFazio, the bill’s primary sponsor.

This type of tax, known as a Financial Transaction Tax (FTT), is progressive given that the wealthiest ten percent of American families own over 80% of overall equities, according to the Federal Reserve Board.

Polling & Findings

In a national survey of likely voters, we provided respondents with the following background on the Wall Street Tax Act: federal lawmakers were considering a bill that would place a tax of 0.1 percent on trades for $100 sold, and would primarily impact “high-frequency” trading, not long-term investments such as employee retirement accounts. High frequency trading involves buying and selling a high volume of shares within a short period of time. It is estimated that this tax could raise $777 billion in new revenue over a 10-year period.

Polling Methodology

From February 5 to February 7, 2021, Data for Progress conducted a survey of 1213 likely voters nationally using web panel respondents. The sample was weighted to be representative of likely voters by age, gender, education, race, and voting history. The survey was conducted in English. The margin of error is ± 2.8 percentage points.