The Case For A Temporary Merger Ban For America’s Largest Companies

Americans overwhelmingly support imposing a merger moratorium on large corporations and private equity firms. This research and analysis is part of our Discourse series. Discourse is a collaboration between The Appeal, The Justice Collaborative Institute, and Data For Progress. Its mission is to provide expert commentary and rigorous, pragmatic research especially for public officials, reporters, […]

Americans overwhelmingly support imposing a merger moratorium on large corporations and private equity firms.

This research and analysis is part of our Discourse series. Discourse is a collaboration between The Appeal, The Justice Collaborative Institute, and Data For Progress. Its mission is to provide expert commentary and rigorous, pragmatic research especially for public officials, reporters, advocates, and scholars. The Appeal and The Justice Collaborative Institute are editorially independent projects of The Justice Collaborative.

At the end of March, Congress passed and President Trump signed into law the CARES Act to protect people financially impacted by the coronavirus. The legislation expanded unemployment insurance and created an emergency small business lending program. But the act also authorized the Federal Reserve to lend to large publicly traded corporations and financial institutions—in other words, it licensed bailouts.

These bailouts permit the Federal Reserve to extend $4 trillion of credit to big corporations and Wall Street. That’s equivalent to a $13,000 loan to every single person in America. But that money isn’t going to working people, communities, or small businesses. Instead, that money is going to be used to bail out large corporations and high-risk investors with few, if any, significant restrictions and limited oversight. Perhaps most outrageously, these bailouts will be used to prop up private equity funds, which should probably not exist.

These provisions represent a massive, enduring transfer of power to billionaires and big businesses with essentially no strings attached. There is no meaningful requirement that this money going to the largest corporations be spent in a manner that will actually help and protect people and businesses most hurt by the coronavirus. Instead, large corporations and financiers have free rein: They’re free to take this money, enrich their CEOs, fire workers, and buy back their own stock. They can also just take the money and use it to buy up smaller competitors, further consolidating economic and political power.

This will make the problem of corporate monopolies and the power they wield in the United States even more dire and further erode the ability of small businesses to remain viable throughout the country. Abusive monopolies will not only survive this economic crisis with assistance from the Federal Reserve, they will be even better positioned to prey on already vulnerable small businesses and gain more power. That translates to these mega-corporations controlling how much you pay for the things you need, how much you get paid for your work, and how much political power you have in this country.

Indeed, study after study points to the deleterious effects of monopolies’ power in our society and democracy. One especially troubling finding: Monopolies leave the average U.S. family $5,000 poorer because they can force workers to accept less pay even as they charge consumers more.

Since there’s no going back in time, it’s critical to seek opportunities to fight this power transfer where we can.

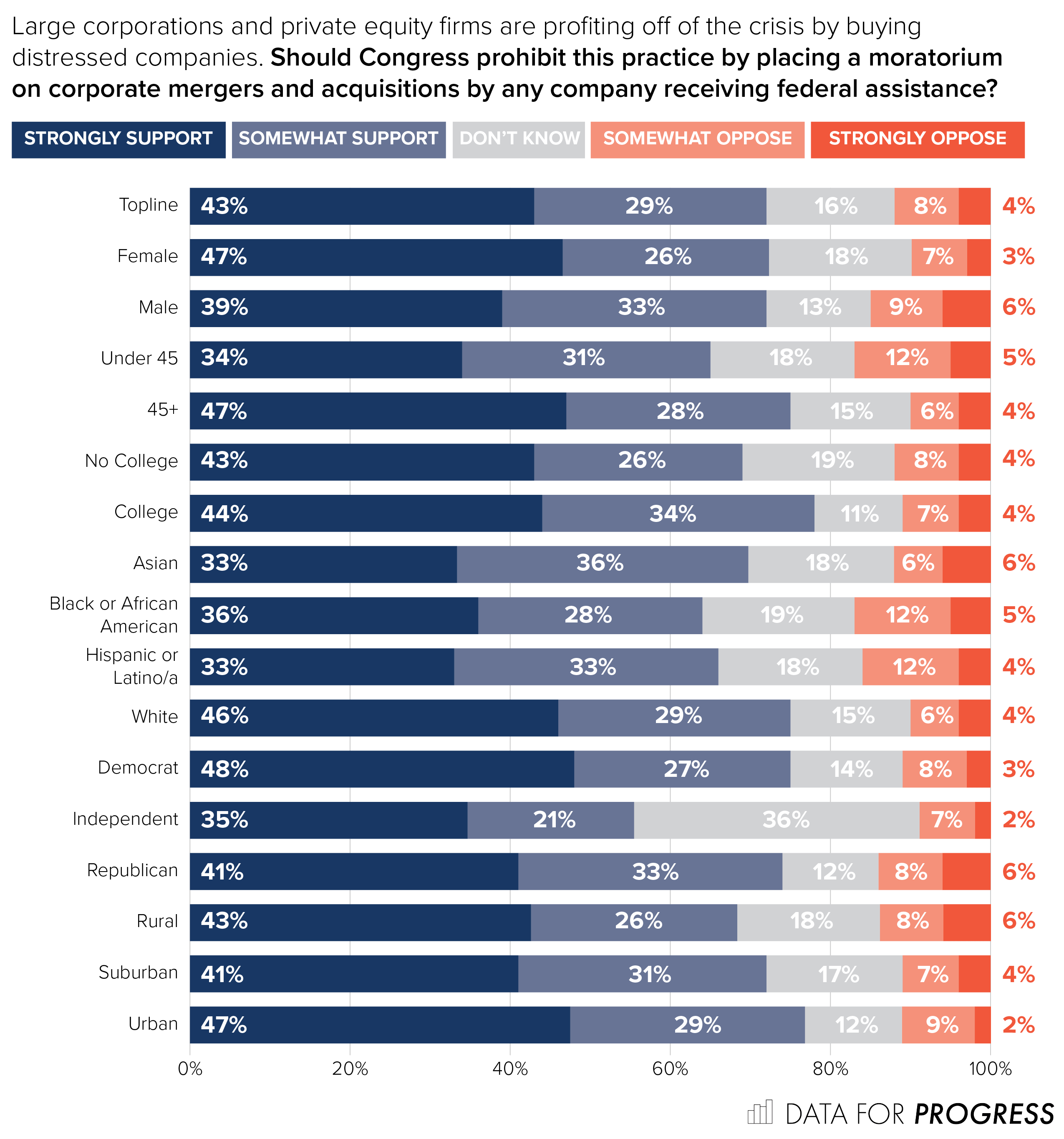

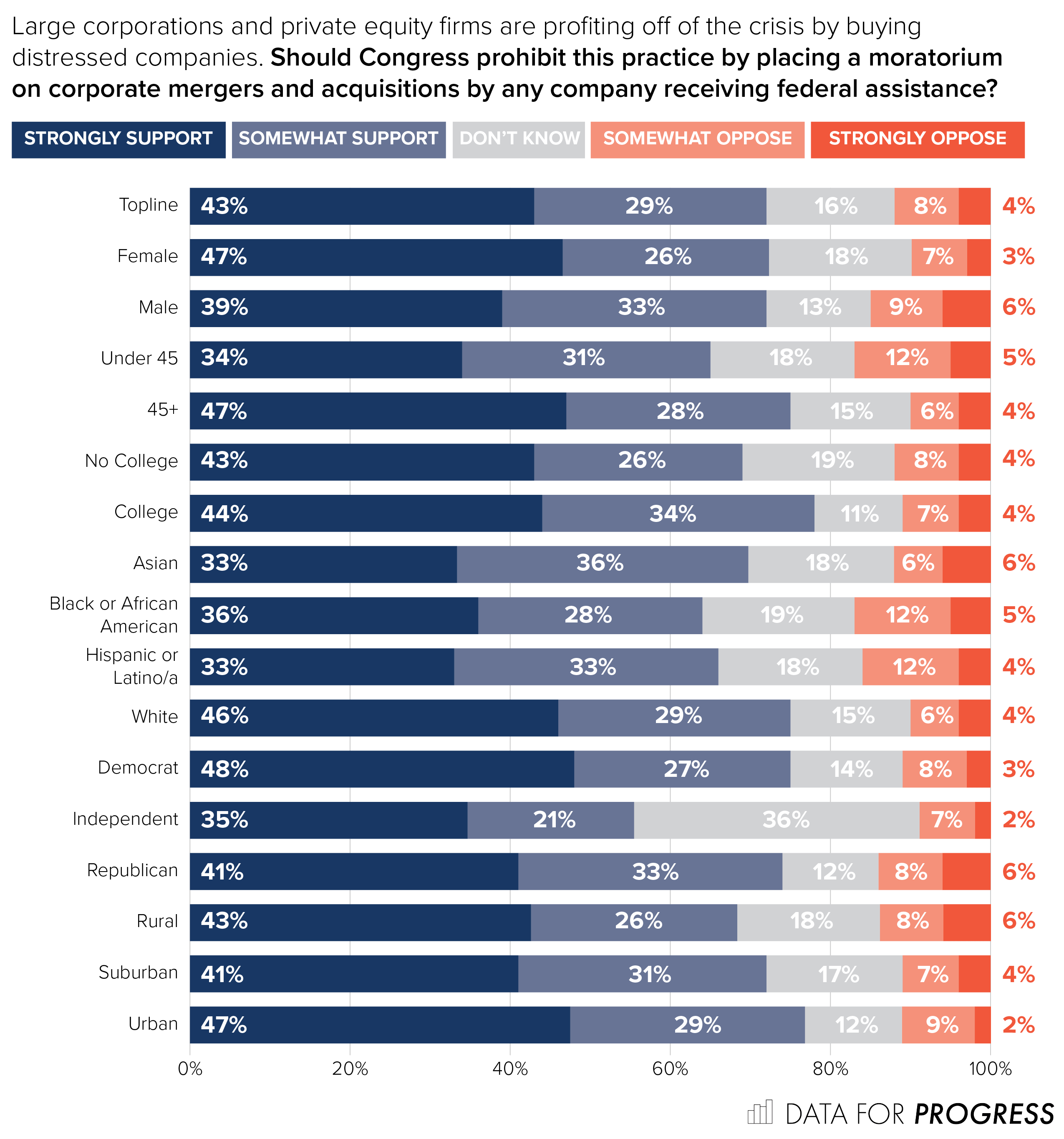

New polling from Data for Progress and The Justice Collaborative Institute finds overwhelming, bipartisan support for one important way to do just that: imposing a merger moratorium on large corporations and private equity firms. Data for Progress asked a nationally-representative sample of 1,700 people, “Large corporations and private equity firms are profiting off of the crisis by buying distressed companies. Should Congress prohibit this practice by placing a moratorium on corporate mergers and acquisitions by any company receiving federal assistance?”

Overall, 72 percent of respondents supported such a ban, with nearly identical, strong support from participants across parties, education levels, and regions. Not a single demographic, whether by gender, ancestry, education level, or party opposed the measure. Of those over 45 years old, 47 percent “strongly supported” such a measure, 28 percent “somewhat supported” the measure, and just 10 percent “somewhat” or “strongly” opposed it.

This new polling shows that the U.S. public both understands this threat and wants those in positions of authority to do something about it. There’s widespread agreement: Big corporations should not use public money to buy their competitors.

As the coronavirus continues to force widespread shutdowns across the country, small and medium-sized businesses are struggling to stay afloat. Many will fail. While communities reel, seeing and suffering the loss of businesses and livelihoods, large corporations and predatory financial capital see something very different: A chance to scoop up, at a steep discount, what they see as promising revenue streams.

A ban on big business’ efforts to merge with or acquire distressed small businesses will help protect markets from corporate control, but alone it won’t be enough. Other necessary steps include bolstering the small business-oriented Paycheck Protection Program and freezing utility payments. And, of course, small businesses will still have the option of combining to survive this crisis—the merger moratorium would apply only to those giant businesses receiving money through a federal institution.

Just now, Senator Elizabeth Warren and Representative Alexandria Ocasio-Cortez have proposed such a ban, asking Speaker Pelosi to incorporate it into the next legislative package. Progressives should insist on it.

Channeling public money toward public goals (such as paying workers and suppliers) and away from private ones (such as squashing small competitors) will mitigate some of the CARES Act’s direction of immense power to private corporations. Without restrictions that prevent big businesses from taking over smaller competitors, the Treasury and the Federal Reserve will use public money to sponsor the steamrolling of struggling small and medium firms by big corporations, letting Wall Street take advantage of crisis to consolidate power.

Banning mega-mergers won’t solve our monopoly problem, but it will help treat the disease—preventing corporate consolidation from accelerating at the moment in which we can least afford it. To work towards a more equitable, inclusive society in which economic and political power isn’t concentrated in the hands of a few billionaires, lawmakers must follow Warren and Ocasio-Cortez’s lead to re-assert essential policy tools, like aggressive corporate oversight, antitrust enforcement, anti-corruption tools, financial regulation, international trade arrangements, and a reinvigorated administrative state. For 40 years, both political parties have largely abandoned these tools to keep corporate power in check. No longer.

The first step in turning the corner is simple: If a large corporation is going to accept public money during this crisis, they shouldn’t be allowed to use it to buy off their competition.

Methodology

On 4/26/2020, Data for Progress conducted a survey of 1702 likely voters nationally using web panel respondents. The sample was weighted to be representative of likely voters by age, gender, education, urbanicity, race, and voting history. The survey was conducted in English. The margin of error is ± 2.1 percent

Sarah Miller is the Executive Director of the American Economic Liberties Project. Previously, she served as the Deputy Director of the Open Markets Institute, which was credited by Rolling Stone as “the driving force behind the resurgence in public understanding and desire for action around antitrust and monopolies.” She is also Co-Chair of Freedom From Facebook, a coalition of progressive groups that succeeded in bringing the concept of breaking up Facebook into the mainstream.