What Biden Can Do To Address The Student Debt Crisis

Civil rights organizations and Democrats in Congress are calling on the president-elect to provide relief to millions of borrowers once he takes office.

Hundreds of thousands of borrowers with disabilities already qualify to have their student debt canceled—yet the Department of Education is still collecting payments.

Approximately 45 million United States residents hold over $1.7 trillion in student debt, and disability rights advocates say the Total and Permanent Disability (TPD) Discharge program is just one of several dysfunctional parts of the system that have contributed to the current student loan crisis.

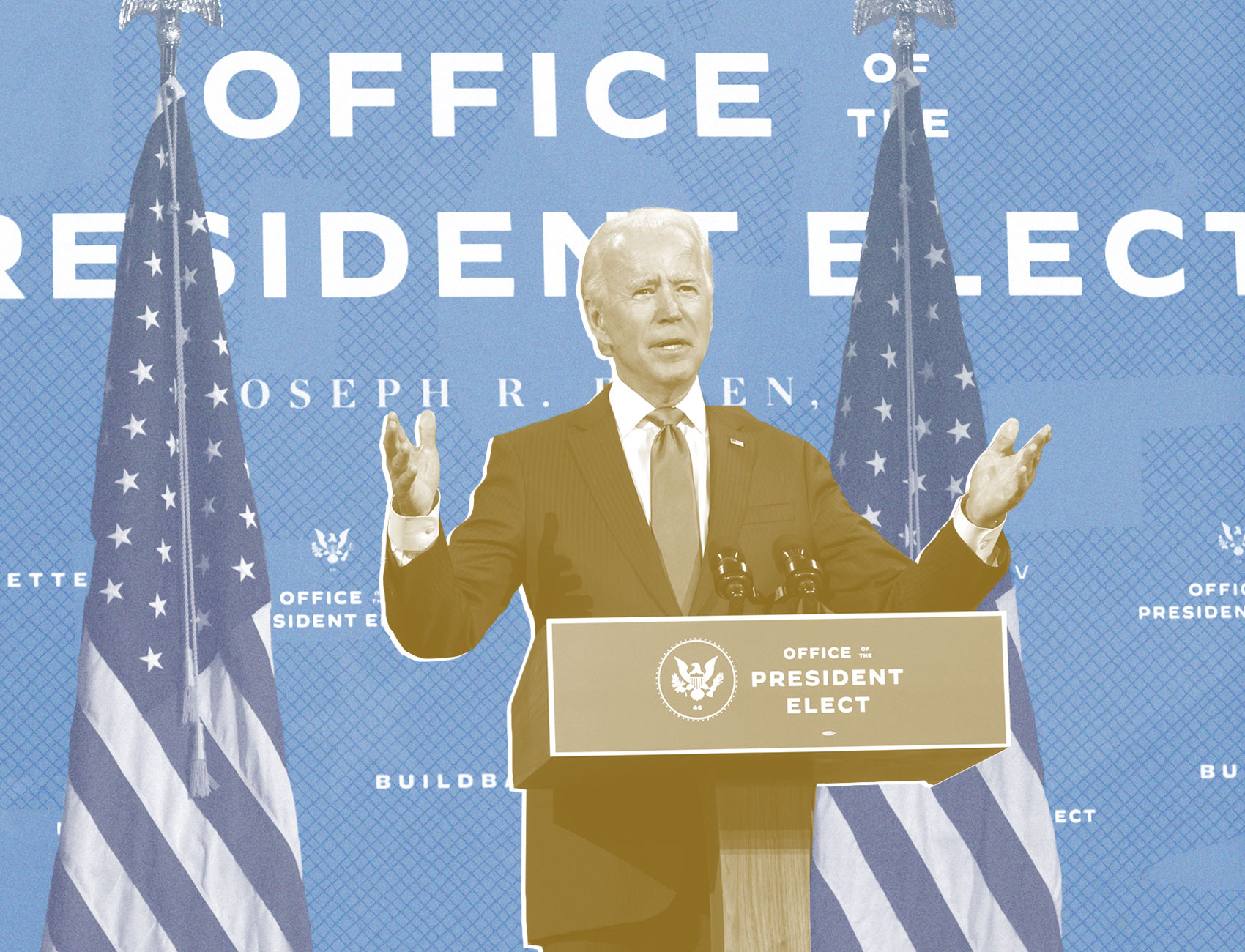

But borrowers need not wait for Congress to intervene. When President-elect Joe Biden takes office, he and his education secretary can provide relief to millions of borrowers—from reforming existing debt relief programs to granting broad-based debt cancellation. And that’s exactly what borrowers, labor unions, students, and members of Congress are calling on the incoming president to do.

Biden is under increasing pressure to use his executive powers to cancel student debt, especially as the suspension on loan payments is set to expire early next year. The federal CARES Act imposed a moratorium on most federal student loan payments through Sept. 30. President Trump then extended the moratorium through the end of the year; last week, Secretary of Education Betsy DeVos announced that the moratorium would be extended through Jan. 31. The Biden-Sanders Unity Task Force recommended cancelling monthly federal student loan payments for the duration of the COVID-19 national emergency.

“We should not be collecting from borrowers in this moment, but at the end of the day that just kicks the can down the road,” said Persis Yu, director of the Student Loan Borrower Assistance Project at the National Consumer Law Center. Yu contributed to a report on debt relief released last month by the Student Borrower Protection Center and Dēmos.

More than three-quarters of borrowers do not feel financially secure enough to resume payments on federal student loans until June 2021 or later, according to a survey released last week by the advocacy group Student Debt Crisis and the technology company Savi.

“Every night I lay awake staring at the ceiling worried about student debt,” a borrower identified as Colleen says in Student Debt Crisis and Savi’s report on the survey. “If it weren’t for food stamps I would not have any food in my home. I cannot live.”

Another borrower is quoted as saying, “My health has declined and now I have more medical bills. I do not know how I will afford my medical bills and doctor visits and medication once I begin making payments.”

Borrowers, Biden told reporters last month, are “having to make choices between paying their student loan and paying their rent.” However, he has not publicly provided many details for his debt relief plan. Biden’s website states that he will “include in the COVID-19 response an immediate cancellation of a minimum of $10,000 of federal student loan debt.”

But civil rights organizations, as well as his Democratic colleagues in Congress, are calling on him to do much more.

More than 200 organizations signed on to a letter to Biden last month, urging him to use his executive powers to cancel federal student loan debt on his first day in office. And in September, Senate Majority Leader Chuck Schumer and Senator Elizabeth Warren introduced a resolution calling for the next president to use his executive authority to cancel up to $50,000 in federal student loan debt. According to a 2019 survey conducted by the Federal Reserve Board, the typical borrower owed more than $20,000 and had monthly payments of more than $200.

“The President of the United States has the power to broadly cancel student loan debt, help close the racial wealth gap, and give a big boost to families and our economy,” Warren said in a statement announcing the resolution.

Twenty years after starting school, the median Black student borrower has $18,500 in loans remaining, while the median white borrower has $1,000 in loans, according to a report released last year by the Institute on Assets and Social Policy at Brandeis University. Of student borrowers who started college in 1995-1996, 49 percent of Black borrowers and 33 percent of Latinx borrowers defaulted, compared with 20 percent of white borrowers.

“Across the board student debt cancellation is a racial and economic justice issue,” Representative Ayanna Pressley said in a statement to The Appeal. In March, Pressley and Representative Ilhan Omar introduced the Student Debt Emergency Relief Act, which would cancel at least $30,000 per borrower.

“On day one of his Administration, President-elect Biden will have the executive authority to cancel billions in student debt with the stroke of a pen—he must do exactly that,” she said.

The TPD program for students with disabilities is emblematic of the flaws in the existing initiatives that are supposed to help student borrowers. The 1965 Higher Education Act allows debt forgiveness for students with “total and permanent disabilities” that have lasted or are expected to last for five years. But the Department of Education’s onerous conditions for borrowers, which go beyond the act’s requirements, prevent most from receiving any relief.

As of February, over 400,000 borrowers with qualifying disabilities had not had their debts forgiven, according to a report released last month by the Office of the Inspector General for the Social Security Administration.

“The Department of Education has created a lot of unnecessary bureaucratic barriers,” said Bethany Lilly, director of income policy at The Arc. Lilly is also an author of the “Delivering on Debt Relief” report.

Once a person is deemed eligible by the Social Security Administration, which determines disability benefits, the Department of Education notifies a borrower of their eligibility. And from there, a bureaucratic maze begins for the borrower, who is already navigating the challenges of living with a chronic and sometimes degenerative disability. The DOE requires the borrower to submit an application online or via a paper form.

“Those folks who, by definition, have challenges working, are being asked, instead, by the Department of Education to fill out complex paperwork,” said Lilly.

For those who are eligible but do not apply, the DOE can still pursue civil actions to collect unpaid debt. Even though Social Security payments cannot be garnished to pay back private debt, the Department of Education can reduce all but $750 of a borrower’s monthly Social Security benefits to collect debts owed on a federal student loan. The Biden-Sanders Unity Task Force recommended ceasing this practice, and cancelling student loans through executive action for borrowers with a total or permanent disability.

The Office of the Inspector General for the Social Security Administration estimates that between May 2016 and November of last year, the DOE used the Treasury Offset Program—which collects past-due debts to government agencies—to collect about $20 million from more than 20,000 people receiving Social Security benefits.

“DOE is aware that these people qualify for student loan forgiveness, but they are still collecting garnishment from them,” said Lilly.

For those who do apply, their loans are suspended during a three-year monitoring period. But their loans can be reinstated during the monitoring period if, for instance, they don’t return required paperwork. Between March 2016 and September 2019, loans were reinstated for nearly 40 percent of people in the monitoring process, according to data obtained by NPR from the Department of Education.

“Lots and lots of people were not able to deal with those bureaucratic hurdles,” said John Whitelaw, who wrote a section of the debt relief report with Lilly.

“The monitoring period is not statutorily required,” continued Whitelaw, who is advocacy director for the Community Legal Aid Society, Inc. in Delaware. “Get rid of the monitoring period. You don’t need it.”

Biden’s Department of Education can ensure more borrowers receive the relief they’re entitled to, according to a report released in October by the National Student Legal Defense Network as part of its 100 Day Docket Series.

The DOE can issue an interim final rule, which immediately suspends all debt collections for borrowers deemed eligible by the Social Security Administration, according to the report. It can also begin the administrative process of changing its rules to automate debt relief and eliminate the monitoring period, according to Student Defense’s report.

“Everything for people with disabilities can be done either by the president directly or by the Department of Education,” said Whitelaw.