Majority Of Americans Support Monthly Cash Assistance To Offset Pandemic Damage To Economy

New polling finds strong bipartisan support for recurring government payments to Americans, rather than a one-time payment.

This research and analysis is part of our Discourse series. Discourse is a collaboration between The Appeal, The Justice Collaborative Institute, and Data For Progress. Its mission is to provide expert commentary and rigorous, pragmatic research especially for public officials, reporters, advocates, and scholars. The Appeal and The Justice Collaborative Institute are editorially independent projects of The Justice Collaborative.

The COVID-19 pandemic is having an unprecedented impact on the U.S. economy and could trigger the “worst economic fallout since the Great Depression.” To provide American families and businesses financial relief, the Senate approved a historic, $2 trillion stimulus package on March 25, 2020. One-time direct payments of $1,200 will be provided to Americans with adjusted gross income up to $75,000 for individuals and $150,000 for married couples. However, there are many people in America being left out.

Universal Basic Income, or UBI, is an unconditional cash transfer to every person in a country. The policy has become widely discussed around the world for years, but in the U.S., it has largely been viewed as a fringe issue, that is, until the 2020 presidential campaign elevated the concept, situating it within the political mainstream. But the debate surrounding basic income has completely changed due to the COVID-19 pandemic. Americans are now calling for the government to make direct payments to protect small businesses and families, and to keep the economy from collapsing.

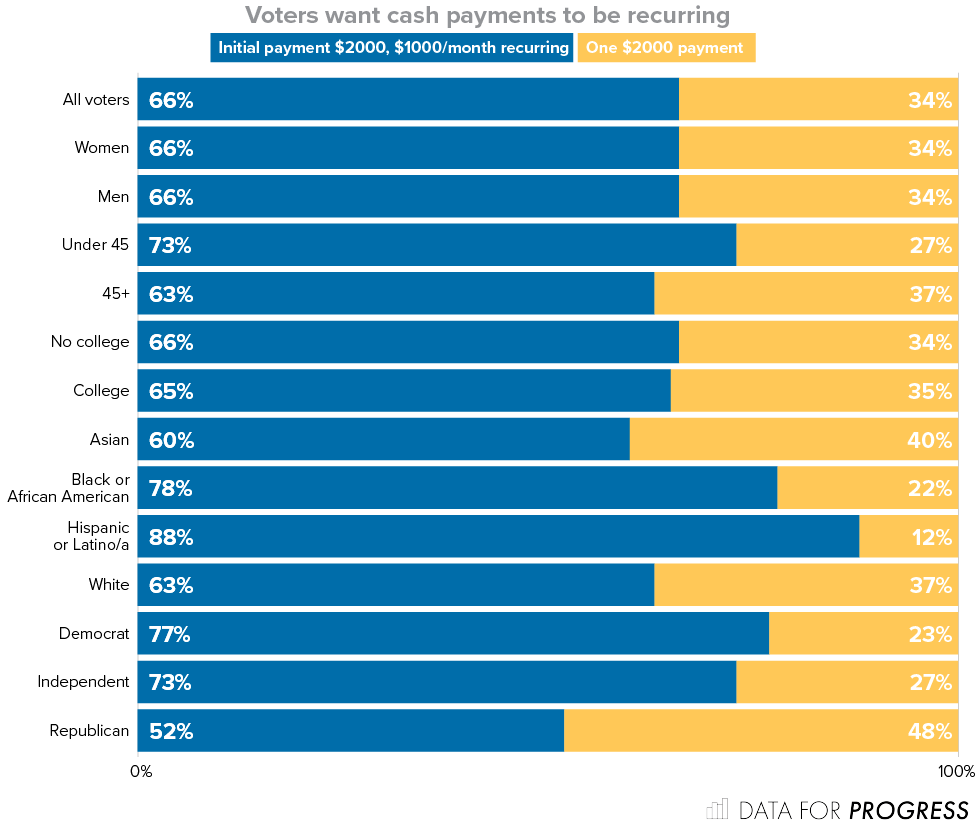

Data for Progress, in partnership with The Justice Collaborative Institute, conducted polling after the stimulus package, showing strong bipartisan support for payments on a recurring basis, rather than the single payment under the current plan. We discuss the full results below, but here’s the topline finding: Nationally, a majority of the public see one-time payments of $2,000 as insufficient: 66% prefers recurring payments of $2,000 until a year after the President declares an end to the federal state of emergency. A majority of Republicans (52%) also agrees with this view.

The impacts of a universal basic income

Economists have reviewed the empirical results of UBI-type programs to understand their implications. The research shows that effects on work are small to non-existent. For example, the U.S. and Canadian negative income tax experiments in the 1970s show the effect of indirect cash benefits to the recipients. The effect of the program on employment was generally not statistically significant. Only the largest experiment site showed a 4 percentage point decline in the employment rate. The Alaska Permanent Fund Dividend — which provides $2000 per person in recent years — had no effect on employment, increased part-time work by 1.8 percentage points, and likely stimulated the local economy.

In the longer run, UBI can catalyze dramatic positive changes in a society. Research shows that access to cash benefits in childhood increases health, educational attainment, and age at death while decreasing criminal life outcomes, reducing drug and alcohol use, and particularly helping disadvantaged youths.

Although there were variations on the UBI programs studied, they had three common components: (1) the program distributes cash directly to the recipient without a means test or other conditions, (2) the funds are distributed over the long term, and (3) everyone within a set geographic area receives the benefit. By contrast, there has been no government-funded cash transfer program in the U.S. The direct cash payments in the stimulus package are similar to a temporary universal basic income in that they reach more than 90% of people without any conditions beyond the means test. They are one time payments, however.

Voters support recurring cash payments over one-off payments

Most UBI-type programs are distributed over the long-term in contrast to the current one-off cash payments. We found strong support among likely voters for recurring cash transfers in response to the COVID-19.

Recent polling indicates that, nationally, 66% of the public prefers receiving recurring payments to one-time payments. This includes a majority of both Democrats (77%) and Republicans (52%).

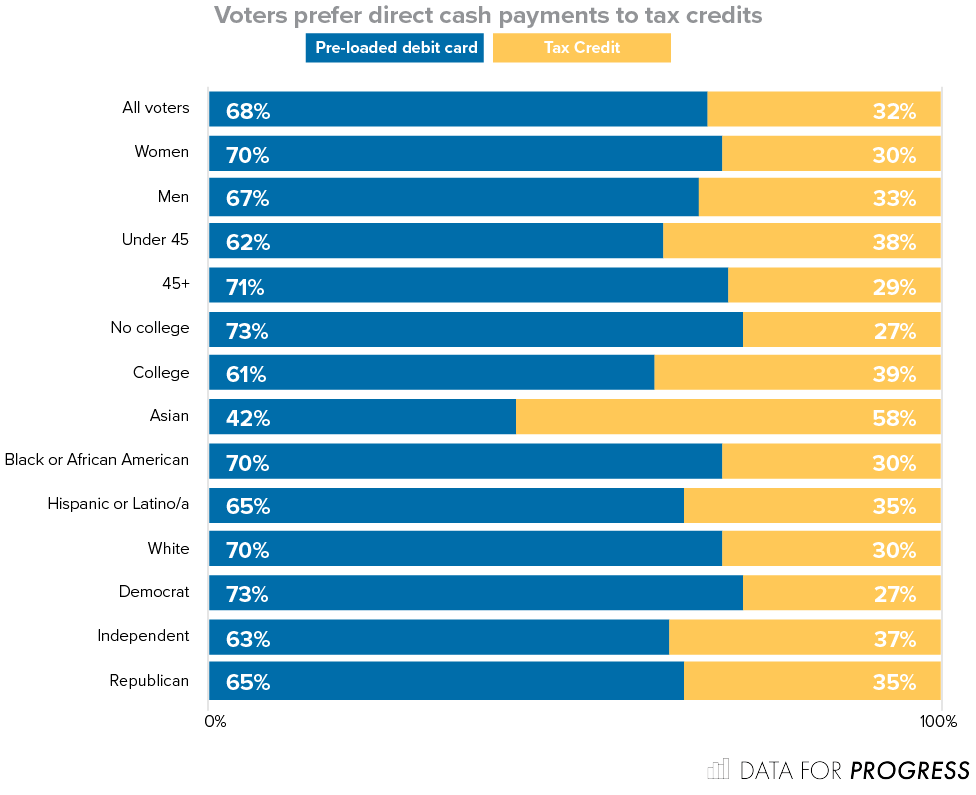

Voters support direct cash payments over tax credits

Most UBI-type programs provide cash directly to the recipient. However, cash can be provided directly through actual cash payments to the recipient or indirectly through tax policies.

Our polling found that 68% of the public prefers receiving a pre-loaded debit card to a deduction on next year’s income tax. This includes a majority of both Democrats (73%) and Republicans (65%).

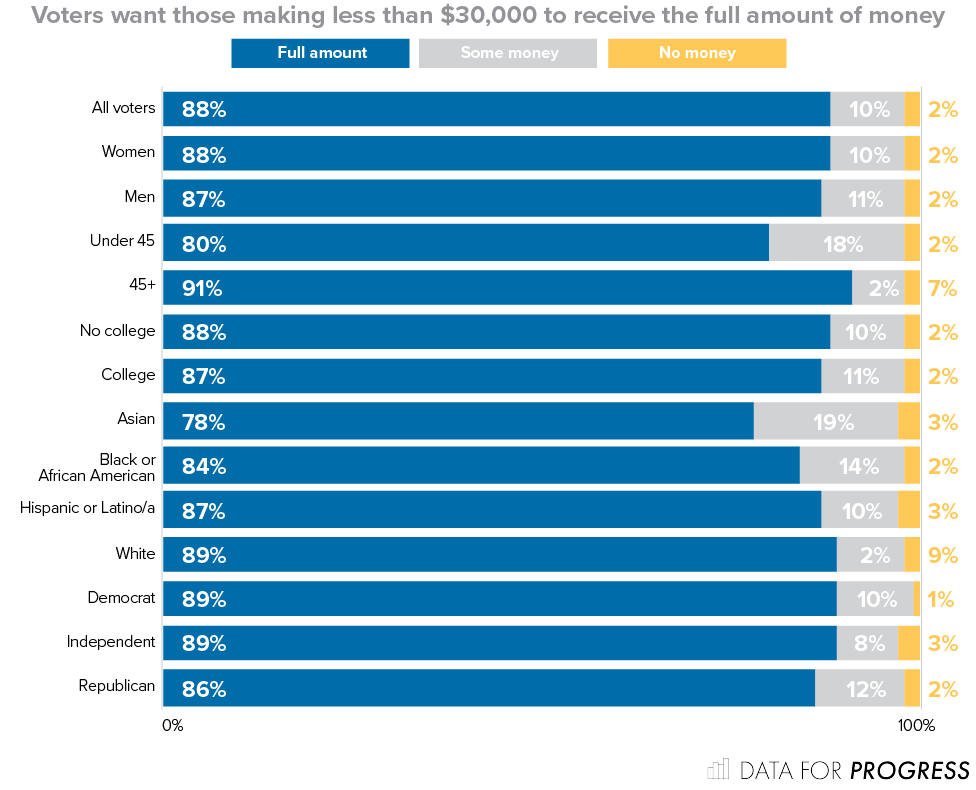

Cash for everyone?

UBI-type programs are distributed to everyone without a means test, unlike the current cash payments that are only provided to Americans who meet certain eligibility criteria. The current stimulus package mostly is limited to taxpayers, which means that many people and families who do not earn enough to file taxes are excluded, and others, including many people experiencing homelessness, will struggle to claim the payment. The current stimulus package also excludes individuals whose incomes exceed $99,000, and many joint filers whose income exceeds $198,000.

Our polling shows a very high support for low-income population making less than $30,000 per year: 88% of those polled nationally agreed that those making less than $30,000 per year should be eligible to receive “full amount” of direct payments from the government. Another 10% support sending some cash to low-income individuals, and only 2% are opposed. However, the polling shows less support for sending cash to the high-income population. Only 14% of the public agreed that those making over $100,000 per year should receive “full amount” of money from the government. This was very similar across party lines. Still, 35% of the public, including 33% of Democrats and 36% of Republicans, agreed that people making over $100,000 per year should receive “some” money from the government.

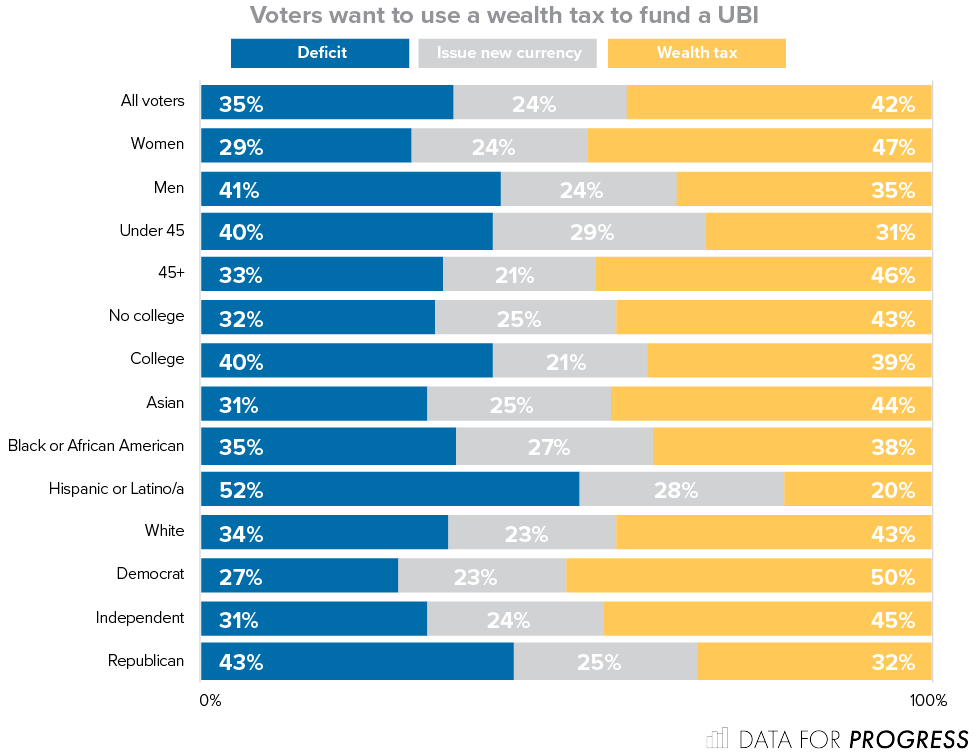

Financing universal basic income

Lastly, it is important to discuss financing UBI-type programs. People question if the UBI is financially feasible and would require additional revenue. Options that are considered for financing cash transfer programs are adding two trillion dollars to the U.S. deficit, instructing the U.S. Treasury to issue two trillion dollars of new currency, and imposing a wealth tax on ultra-millionaires and billionaires. A majority of voters, including a majority of both Republicans and Democrats, support each of the methods for financing recurring UBI payments.

When we presented these three options and required voters to choose their favorite option, imposing a wealth tax (42%) was supported the most from the public, followed by adding to the deficit (35%) and then by using new currency (24%). Republicans preferred adding the deficit the most (42%) and Democrats preferred the wealth tax the most (50%).

Americans support recurring cash payments

The COVID-19 pandemic has led the US government to implement a one-time cash payment that resembles a universal basic income. Americans are supportive of this move and a broad majority wishes to see the payments extended for at least until a year after the state of emergency ends.

From March 27, 2020 to March 28, 2020, Data for Progress conducted a survey of 2022 likely voters nationally using web panel respondents. The sample was weighted to be representative of likely voters by age, gender, education, urbanicity, race, and voting history. The survey was conducted in English. The margin of error is ± 2.1 percent.